US President Donald Trump says he’ll announce tariffs on all metal and aluminium imports to the US, as he reshapes America’s buying and selling relationship with the world.

The transfer may have a selected impression on neighbouring Canada, which is the most important provider of aluminium to the US. Trump has additionally threatened to introduce tariffs at a later date on different merchandise from Canada, in addition to Mexico.

He has already launched a levy of 10% on all merchandise coming into from China – which has responded with its personal measures.

The US president says these import taxes are wanted to assist the US economic system and to “defend” the nation from unlawful immigration and the movement of medicine. Economists say they might push up costs for People.

What are tariffs and the way do they work?

Tariffs are taxes charged on items imported from different international locations.

Corporations that import items from overseas pay the tariffs to the US authorities.

Trump has launched a ten% tariff on all items from China. So, a product value $10 would have a further $1 cost utilized to it.

The president initially mentioned he would impose a 25% tariff on items from Canada and Mexico, however later agreed to pause these after each international locations agreed to spice up border safety.

Charging a proportion of a product’s worth is the commonest kind of tariff. One other kind imposes a set determine on imports, no matter their worth.

Why is Trump utilizing tariffs?

Trump is fulfilling a marketing campaign promise of introducing import duties towards a few of America’s closest buying and selling companions.

He argues that tariffs will enhance US manufacturing and defend jobs – for instance within the US metal business – in addition to elevating tax income and rising the economic system.

He has additionally sought to justify tariffs on metals – which he additionally launched throughout his first time period – as a nationwide safety situation.

Trump additionally says he’s utilizing tariffs to “fight the scourge of fentanyl”, a robust drug that causes tens of 1000’s of overdose deaths within the US annually.

His administration says chemical substances used to make the drug come from China, whereas Mexican gangs provide it illegally and have fentanyl labs in Canada.

Canadian Prime Minister Justin Trudeau has mentioned lower than 1% of fentanyl coming into the US comes from his nation.

What is going on with China, Canada and Mexico?

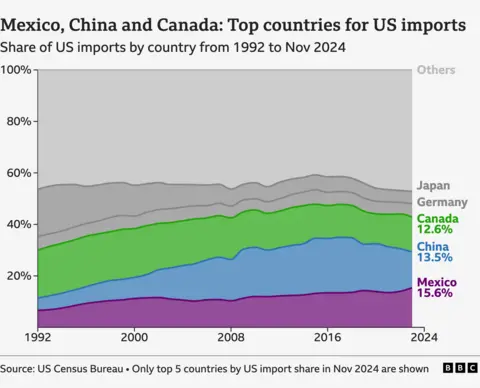

Collectively, China, Mexico and Canada accounted for greater than 40% of imports into the US final 12 months, making them a few of Trump’s most precious commerce companions.

China

A ten% cost on all items imported from China to the US took impact on 4 February.

Beijing retaliated with its personal tariffs that took impact on 10 February. These embrace a 15% tariff on US coal and liquefied pure fuel merchandise, and a ten% tariff on crude oil, agricultural equipment and huge engine automobiles.

China has repeatedly voiced its opposition to a brand new commerce warfare of the type that developed between the 2 international locations throughout Trump’s first presidency.

Canada

Trump paused for 30 days a proposed tariff of 25% on all items coming into from Canada – which was additionally resulting from start on 4 February.

Canada additionally paused its personal retaliatory tariff of 25% on 155bn Canadian {dollars}’ value ($107bn; £86bn) of US imports.

In alternate for Trump’s pause, Canadian Prime Minister Justin Trudeau mentioned Canada was implementing a “$1.3bn border plan” so as to add “new choppers, expertise and personnel to frame,” in addition to “elevated sources to cease the movement of fentanyl”.

A lot of the border safety plan had already been introduced in December.

Trump mentioned the delay would enable the US to see “whether or not or not a remaining financial take care of Canada” may very well be reached.

Mexico

The proposed 25% tariffs towards Mexico have additionally been delayed a month, as have measures by Mexico towards US items.

Mexico’s President Claudia Sheinbaum agreed to ship 10,000 members of the Nationwide Guard to the US-Mexican border to “forestall the trafficking of medicine, specifically fentanyl”.

President Sheinbaum mentioned the US had in flip agreed to extend measures to stop the trafficking of high-powered US weapons into Mexico.

Which merchandise might be affected?

Throughout Trump’s earlier time in workplace, he utilized much less restrictive tariffs on China. This time round, the tariffs seem to use to all items from China.

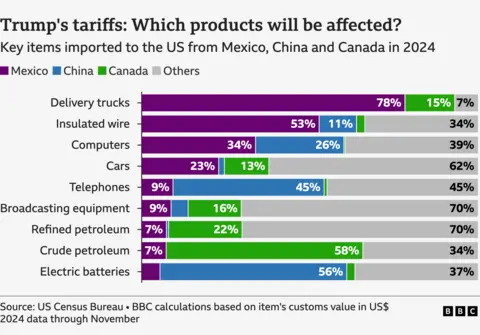

If the measures towards items from Mexico and Canada in the end go forward, a spread of things are anticipated to change into costlier.

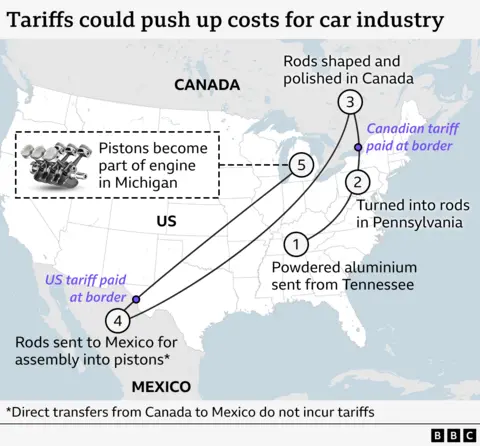

Automotive manufacturing may bear the brunt of the consequences of tariffs.

Car elements cross the US, Mexican and Canadian borders a number of instances earlier than a car is totally assembled.

The typical US automobile value may improve by $3,000 due to the import taxes, monetary analyst TD economics instructed.

Different items from Mexico which may very well be affected embrace fruit, greens, spirits and beer.

Canadian items equivalent to metal, lumber, grains and potatoes would even be more likely to get pricier for US customers.

Canadian power could be tariffed at 10% as a substitute of 25%.

Will the UK and Europe should pay tariffs?

Trump beforehand instructed the BBC the UK was performing “out of line”, with out giving additional element, however instructed an answer may very well be “labored out”.

The UK’s enterprise secretary, Jonathan Reynolds, mentioned the UK ought to be excluded from tariffs as a result of the US exports extra merchandise to the UK than it imports.

The UK exports pharmaceutical merchandise, automobiles and scientific devices to the US.

Trump has additionally mentioned he may impose tariffs on the EU “fairly quickly”, as a result of “they take virtually nothing [from the US] and we take all the things from them”.

Final 12 months, the US had a commerce deficit of $213bn with the EU – which Trump described as “an atrocity”.

The EU has mentioned it might “reply firmly” to any tariffs. US firms Harley Davidson, which manufactures bikes, and whiskey distilleries equivalent to Jack Daniel’s have beforehand confronted EU tariffs.

Do tariffs trigger inflation?

Economists have warned that tariffs are more likely to increase costs for US customers.

For instance, sellers might increase the value of products they’re importing if they’re compelled to pay increased duties.

From 2018 to 2023, tariffs on imported washing machines noticed the value of laundry gear rise by 34%, in line with official statistics, earlier than falling as soon as the tariffs expired.

Some specialists counsel that these new tariffs may immediate a wider commerce warfare and exacerbate inflation.

Capitol Economics has mentioned the annual charge of inflation may improve from 2.9% to as excessive as 4% due to the newly introduced tariffs.