BBC Information and File on 4 Investigates

BBC

BBCSanctioned Russian oligarch Roman Abramovich may owe the UK as much as £1bn after a botched try and keep away from tax on hedge fund investments, proof seen by the BBC suggests.

Leaked papers reveal investments price $6bn (£4.7bn) had been routed by means of firms within the British Virgin Islands (BVI). However proof suggests they had been managed from the UK, so ought to have been taxed there.

A number of the cash that funded Chelsea FC when Mr Abramovich owned it may be traced again to firms concerned within the scheme, the BBC and the Bureau of Investigative Journalism (TBIJ) additionally discovered.

The oligarch’s legal professionals stated he “at all times obtained unbiased knowledgeable skilled tax and authorized recommendation” and “acted in accordance with that recommendation”. He denies having any information or being personally chargeable for any unpaid tax.

Joe Powell, a Labour MP who leads a Parliamentary group on honest taxation, known as on HM Income and Customs to “urgently” examine the case to get well what could possibly be “very vital quantities of cash that could possibly be invested in public companies”.

On the coronary heart of the scheme was Eugene Shvidler, a former Chelsea FC director and a billionaire businessman in his personal proper, who’s at the moment difficult the UK authorities’s resolution to sanction him for his shut hyperlinks to Mr Abramovich.

Mr Shvidler moved to the USA after Russia’s invasion of Ukraine, however from 2004 till 2022 he lived within the UK, with properties in London and Surrey.

A tax knowledgeable instructed the BBC that proof Mr Shvidler had been making strategic selections on the investments whereas primarily based within the UK, and never within the BVI, was “a reasonably large smoking gun”, suggesting the businesses ought to have been paying UK tax.

Attorneys for Mr Shvidler stated the BBC was basing its reporting on “confidential enterprise paperwork that current an incomplete image” and had “drawn robust and faulty conclusions as to Mr Shvidler’s conduct”.

They stated “the construction of investments” was “the topic of very cautious and detailed tax planning, undertaken and suggested on by main tax advisors”.

The scheme involving Mr Abramovich’s hedge fund investments was revealed in an enormous leak of knowledge that the BBC and the Bureau of Investigative Journalism have been inspecting for over a yr – hundreds of information and emails from a Cyprus-based firm that administered Mr Abramovich’s international empire.

Getty Photographs

Getty PhotographsThe BBC and its media companions, together with The Guardian, have been reporting on the leaked information since 2023 as a part of the Worldwide Consortium of Investigative Journalists’ Cyprus Confidential investigation. On Tuesday, we revealed how Mr Abramovich had dodged hundreds of thousands in VAT on the working prices of his yacht fleet.

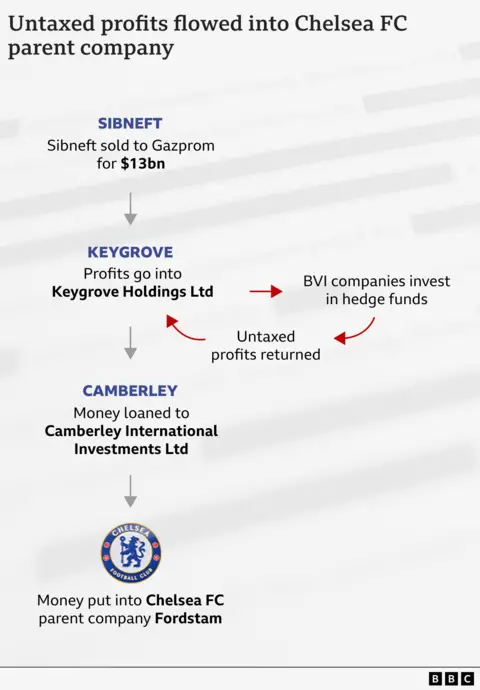

The leaked knowledge reveals how Mr Abramovich invested a big a part of the wealth he acquired within the Nineties by means of a corrupt deal – ploughing it into an organization within the BVI known as Keygrove Holdings Ltd.

A community of British Virgin Islands firms owned by Keygrove invested this cash – as much as $6bn (£4.8bn) between the late Nineties and early 2020s – into Western hedge funds, in line with the leaked information.

These investments made the oligarch an estimated $3.8bn (£3.1bn) in earnings over nearly twenty years. By making the investments by means of firms within the BVI, which doesn’t levy tax on company earnings, the scheme seems to be arrange to make sure as little tax as attainable was paid.

‘Full energy to do something’

It isn’t uncommon for companies to legally keep away from paying tax on their earnings by making their investments from firms in tax havens. However the firms concerned should be managed and managed offshore the place they’re integrated.

If an offshore firm’s strategic selections are being taken by somebody within the UK, its earnings could possibly be taxed as if it had been a UK firm.

The leaked paperwork present how the administrators of the BVI funding firms handed sweeping powers over them to Mr Shvidler, who was dwelling within the UK and gained British citizenship in 2010.

The BBC has seen “common energy of lawyer” paperwork dated between 2004 and 2008, that gave him the “broadest attainable powers” and “full energy to do every part and something” to funding firms within the BVI.

From 2008, Mr Shvidler seems to have acquired the facility to direct the investments of Keygrove, which owned the BVI firms, by means of one other firm.

Millennium Capital Ventures Ltd, which was owned not directly by Mr Shvidler’s spouse and appointed him as a director in 2000, turned Keygrove’s funding supervisor. It was assigned “full energy and authority to oversee and direct” the funding of the belongings, “all with out prior session with consumer”.

‘Robust proof’

Additional proof of Mr Shvidler’s essential position within the funding selections of the BVI firms emerged in a court docket case introduced in September 2023 by the US Securities and Alternate Fee (SEC) in opposition to a New York agency known as Harmony Administration.

The SEC submitting says that Harmony had just one consumer, since recognized as Mr Abramovich. The corporate suggested on funding selections for the oligarch’s BVI firms.

It identifies a “longtime shut affiliate” of Mr Abramovich, known as “Individual B”, who “made funding selections” for Mr Abramovich.

It says he was “the purpose of contact for receiving funding recommendation” and “for both deciding or speaking the choice whether or not to go ahead with really useful transactions”.

Utilizing the leaked paperwork, the BBC was capable of establish “Individual B” as Eugene Shvidler.

The proof suggests Mr Shvidler was making the choices described by the SEC, managing and controlling Mr Abramovich’s investments, from the UK somewhat than the BVI.

Getty Photographs

Getty PhotographsTax knowledgeable Rita de le Feria instructed the BBC that proof a UK resident, equivalent to Mr Shvidler, was taking “strategic large selections” on the hedge fund investments was a “clear indication” the massive earnings ought to have been taxed by the UK.

“I feel it is a fairly large smoking gun. That might be, once more, robust proof that the efficient administration of the corporate was not going down within the BVI,” she stated.

Mr Shvidler’s legal professionals stated there might be “no query of Mr Shvidler, both knowingly or negligently, being concerned in an illegal scheme to keep away from paying tax”.

Attorneys for Mr Abramovich stated that along with the recommendation he obtained over his tax affairs, he “expects that comparable recommendation was sought” by these with duty for working firms associated to him.

The leaked paperwork additionally reveal how giant quantities of the untaxed earnings from Mr Abramovich’s hedge fund investments handed by means of a community of the oligarch’s firms earlier than flowing into Chelsea FC.

The hedge fund investments flowed again into his firms within the BVI after which into Keygrove, their dad or mum firm.

Keygrove then loaned out cash to different firms in Mr Abramovich’s community, which in flip lent cash to Camberley Worldwide Investments Ltd – an organization set as much as bankroll Chelsea FC.

By 2021, when Chelsea received the Champions League, Membership World Cup and UEFA Tremendous Cup, tons of of hundreds of thousands of {dollars} in loans to the membership could possibly be traced again to firms benefiting from Mr Abramovich’s untaxed hedge fund investments.

How we calculated the invoice

If HMRC had been to research, how a lot may Mr Abramovich or the businesses involved owe?

We’ve got assessed the earnings made by the funding firms within the BVI from 1999 to 2018.

The leaked paperwork solely comprise full accounts for the businesses investing in hedge funds from 2013 to 2018.

However we are able to estimate how a lot cash the businesses concerned had been more likely to have remodeled all the interval by their “income reserves”. These are earnings stored within the companies, somewhat than being paid out to shareholders. By the top of 2018 this amounted to $3.8bn.

Making use of historic UK company tax and forex conversion charges to the income reserves as much as 2012, and the yearly earnings to 2018, quantities to a possible tax invoice of greater than £500m owed to HMRC.

Getty Photographs

Getty PhotographsHowever within the occasion of an enquiry into unpaid tax, HMRC may also impose late cost curiosity and penalties for failure to inform the authorities.

If tax has gone unpaid, then relying on whether or not an investigation concluded these accountable knew however didn’t inform HMRC, or whether or not they didn’t know, the entire quantity due may vary from nearly £700m to over £1bn.

There’s a chance that some tax on the earnings couldn’t be recovered, as HMRC investigations can solely return a most of 20 years.

Nevertheless, our calculations are additionally more likely to be an underestimate, as a result of now we have utilized the bottom price of company tax that existed between 1999 and 2012, and it’s attainable earnings had been extracted from the businesses in that interval that now we have not included in our sums.

In any occasion, Mr Abramovich’s tax invoice may dwarf the £653m invoice imposed on Formulation One boss Bernie Ecclestone in 2023.

Frozen funds

Following Russia’s full-scale invasion of Ukraine, the British authorities allowed Roman Abramovich to promote Chelsea FC to Todd Boehly. It did so on the situation that £2.5bn from the proceeds could be donated to charities supporting victims of the warfare in Ukraine.

Practically three years later, the cash nonetheless sits in a frozen Barclays checking account, reportedly as a consequence of disagreement over the way it needs to be spent, with Mr Abramovich wanting the cash to go to “all of the victims” of the warfare, and the UK authorities insisting it needs to be spent solely on humanitarian help in Ukraine.

The BBC’s investigation means that, simply as Ukrainians are ready for cash from the previous Chelsea boss, so is the British taxpayer.

Cyprus Confidential is worldwide collaborative investigation launched in 2023 led by the Worldwide Consortium of Investigative Journalists (ICIJ) into Cyprus companies offered company and monetary companies to associates of Russian President Vladimir Putin’s regime.

Media companions embody The Guardian, the investigative newsroom Paper Path Media, the Italian newspaper L’Espresso, the Organised Crime and Corruption Reporting Venture (OCCRP) and the Bureau of Investigative Journalism (TBIJ).

TBIJ reporting workforce: Simon Lock and Eleanor Rose.