China correspondent

A hiss and puff of compressed air shapes the graceful leather-based, bringing to life an all-American cowboy boot in a manufacturing unit on China’s japanese coast.

Then comes one other one because the meeting line continues, the sounds of stitching, stitching, reducing and soldering echoing off the excessive ceilings.

“We used to promote round one million pairs of shoes a 12 months,” says the 45-year-old gross sales supervisor, Mr Peng, who didn’t want to reveal his first title.

That’s, till Donald Trump got here alongside.

A slew of tariffs in his first presidential time period triggered a commerce struggle between the world’s two largest economies. Six years on, Chinese language companies are bracing themselves for a sequel now that he’s again within the White Home.

“What route ought to we take sooner or later?” Mr Peng asks, unsure of what Trump 2.0 means for him, his colleagues – and China.

A battle looms

For Western markets which can be more and more cautious of Beijing’s ambitions, commerce has develop into a robust bargaining chip – particularly as a sluggish Chinese language financial system depends ever extra on exports. Trump returned on a marketing campaign promise that included crushing tariffs in opposition to Chinese language-made items, and has since threatened a ten% levy that’s anticipated to take impact on 1 February.

He has additionally ordered a assessment of US-China commerce – which buys Beijing time and Washington, negotiating room. And for now, harsher rhetoric (and better tariffs) appear to be directed in opposition to US allies akin to Canada and Mexico.

Trump could have pressed pause on the looming battle with Beijing. However many consider it is nonetheless coming. It is exhausting to search out a precise determine on what number of companies are fleeing China, however main companies akin to Nike, Adidas and Puma have already relocated to Vietnam. Chinese language companies too have been shifting, reshaping provide chains, though Beijing stays a key participant.

Mr Peng says his boss, who owns the manufacturing unit, has thought of shifting manufacturing to South East Asia, together with lots of their opponents.

It will save the agency, however they’d lose their workforce. A lot of the workers are from the close by metropolis of Nantong and have labored right here for greater than 20 years.

Mr Peng, whose spouse died when their son was younger, says the manufacturing unit has been his household: “Our boss is set to not abandon these workers.”

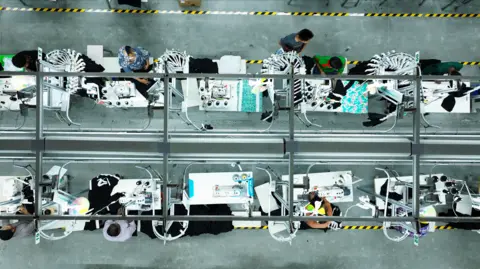

Xiqing Wang/ BBC

Xiqing Wang/ BBCHe’s conscious of the geopolitics at play, however he says he and his employees are simply attempting to make a dwelling. They’re nonetheless reeling from the affect of 2019, when a fourth spherical of Trump tariffs – 15% – hit Chinese language-made client items, akin to garments and footwear.

Orders have since dwindled and workers numbers, as soon as greater than 500, have dropped to only over 200. The proof is within the empty work stations, as Mr Peng reveals us round.

Throughout him, employees are reducing the leather-based into the proper form handy it to the machinist. They must be exact as a result of errors will spoil the costly leather-based, most of which has been imported from the US.

The manufacturing unit is attempting to maintain prices low as a few of their American patrons are already contemplating shifting enterprise away from China and the specter of tariffs.

However that will imply dropping expert employees: it will probably take as much as per week to make one pair of shoes, from flattening the leather-based to giving the completed boots a last polish and packing them for export.

That is what turned China into the world’s high producer – labour-intensive manufacturing which can also be low-cost when it is scaled up and supported by an unrivalled provide chain. And this has been years within the making.

“It was as soon as a relentless cycle of inspecting items and transport them out – I felt fulfilled,” says Mr Peng, who has labored right here since 2015. “However orders have decreased, which makes me really feel fairly misplaced and anxious.”

As soon as crafted to beat the Wild West, these cowboy boots have been made right here for greater than a decade. And this can be a acquainted story within the south of Jiangsu province, a manfucaturing hub alongside the Yangtze River that produces nearly every thing, from textiles to electrical automobiles.

Xiqing Wang/ BBC

Xiqing Wang/ BBCThese are among the many a whole lot of billions of {dollars} value of products that China ships to the US yearly – a quantity that steadily ballooned as Washington turned its largest buying and selling associate.

That standing slipped below Trump. However it was not restored below his successor Joe Biden, who stored most Trump-era tariffs in place, as ties with Beijing frayed.

The truth is, the European Union too has imposed tariffs on electrical automobile imports, accusing China of creating an excessive amount of, typically with the assist of state subsidies. Trump has echoed this – that China’s “unfair” commerce practices drawback overseas comeptitors.

Beijing sees such rhetoric as Western makes an attempt to stifle its development, and it has repeatedly warned Washington that there shall be no winners in a commerce struggle. However it has additionally mentioned it is prepared to speak and “correctly deal with variations”.

And President Trump, who has described tariffs as his “one huge energy” over China, definitely needs to speak.

It is unclear as but what he would possibly need in return. Throughout Trump’s honeymoon interval with China in his first time period he got here to Beijing to ask for Xi’s assist in assembly North Korea’s chief Kim Jong Un. This time it’s believed he would possibly want Xi’s assist to make a take care of Russian President Vladimir Putin to finish the struggle in Ukraine. He not too long ago mentioned that China had “quite a lot of energy over that scenario”.

The specter of a ten% tariff is pushed by the idea that China is “sending fentanyl to Mexico and Canada”. So he might demand that it do extra to finish that movement.

Or, given he welcomed a bidding struggle over TikTok, he could wish to negotiate its possession – or the prized know-how that powers the app – as a result of Beijing would want to conform to any such sale.

Xiqing Wang/BBC

Xiqing Wang/BBCRegardless of the deal could also be, it might assist reset US-China ties. Nonetheless, the absence of 1 might abruptly finish the possibility of a second honeymoon, organising Trump and Xi for a much more confrontational relationship.

Already enterprise sentiment is nervous: an annual survey by the American Chamber of Commerce in China confirmed simply over half of them had been involved concerning the US-China relationship deteriorating additional.

Trump’s seemingly softer stance on China presents presents some reduction. However his hope continues to be that the specter of tariffs will assist drive patrons away from China and transfer manufacturing again to the US.

Some Chinese language companies are certainly on the transfer – however to not America.

Shifting store

An hour outdoors Cambodia’s capital Phnom Penh, businessman Huang Zhaodong has constructed a brand new manufacturing unit to cater to a flood of orders from US giants Walmart and Costco.

That is his second manufacturing unit in Cambodia, and collectively they produce half one million clothes a month, from shirts to underwear. Hangers carrying cotton trousers roll previous us on an automatic line, shifting from one station to the subsequent because the elastic waist is inserted and hemlines are completed.

Xiqing Wang/ BBC

Xiqing Wang/ BBCNow, when potential US prospects lob the primary query, which he has come to anticipate – the place is he primarily based – Mr Huang has the proper reply. Not in China.

“Within the case of some Chinese language companies, their prospects have advised them: ‘In case you do not transfer manufacturing abroad, I am going to cancel your orders’.”

The tariffs elevate robust selections for suppliers and retailers, nevertheless it’s not all the time clear who will bear the brunt of the price. Typically it is going to be the client, Mr Huang says.

“Take Walmart for instance. I promote them garments at $5, however they often mark it up 3.5 occasions. If the price will increase attributable to increased tariffs, the worth I promote to them would possibly rise to $6. In the event that they mark it up by 3.5 occasions, the retail value would enhance.”

However often, he says, it’s the provider. If his manufacturing line was in China, he estimates an additional 10% tariff might take an additional $800,000 (£644,000) from his earnings.

“That is greater than what I make as revenue. It is enormous and we will not afford it. In case you’re making garments in China below such tariff circumstances, it is unsustainable,” he says.

Present US tariffs on Chinese language items range from 100% on electrical automobiles to 25% on metal and aluminium. Till now, a number of top-selling objects have been exempt, together with electronics, akin to TVs and iPhones.

However the 10% blanket tariff Trump is proposing might have an effect on the worth of every thing that’s made in China and exported to the US. That applies to a number of issues – from toys and tea cups to laptops.

Xiqing Wang/ BBC

Xiqing Wang/ BBCMr Huang says this may encourage extra factories to maneuver elsewhere. A number of new workshops have sprung up round him and Chinese language firms from textile manufacturing heartlands akin to Shandong, Zhejiang, Jiangsu and Guangdong are shifting in to make winter jackets and woollen clothes.

Round 90% of clothes factories in Cambodia at the moment are Chinese language-run or Chinese language-owned, in response to a report by perception and evaluation group Analysis and Markets.

Half of the nation’s overseas funding flows from China. Seventy % of roads and bridges had been constructed utilizing loans Beijing distributed, in response to Chinese language state media.

Most of the indicators on eating places and outlets are in Chinese language in addition to Khmer, the native language. There’s even a hoop highway named Xi Jinping Boulevard in honour of the Chinese language president.

Cambodia shouldn’t be a lone recipient. China has invested closely in numerous elements of the world below President Xi’s Belt and Street Initiative – a commerce and infrastructure challenge that additionally will increase Beijing’s affect.

Which means China has selections.

Chinese language state media claims that greater than half of China’s imports and exports now come from Belt and Street international locations, most of them in South East Asia.

Xiqing Wang/BBC

Xiqing Wang/BBCThis has not occurred in a single day, says Kenny Yao from AlixPartners, who advises Chinese language companies on the best way to take care of tariffs.

Throughout Trump’s first time period, many Chinese language companies doubted his tariff risk, he advised the BBC. Now they ask if he’ll comply with the availability chain and slap tariffs on different international locations.

Simply in case he does, Mr Yao says, it could be sensible for Chinese language companies to look additional afield: “For instance, Africa or Latin America. That is harder, however it’s good to take a look at areas you haven’t explored earlier than.”

As America pledges to take care of itself first, Beijing is doing its finest to look a secure enterprise associate, and there’s some proof it’s working.

China has edged previous the US to develop into the prevailing alternative for international locations in South East Asia, in response to a survey by the Iseas Yusof-Ishak suppose tank in Singapore.

Although manufacturing has moved overseas, cash nonetheless flows to China – 60% of the supplies being made into garments at Mr Huang’s factories in Phnom Penh come from China.

And exports are thriving, with Beijing investing extra closely in high-end manufacturing, from photo voltaic panels to synthetic intelligence. Final 12 months’s commerce surplus with the world – on the again of a virtually 6% year-on-year bounce in exports – was a file $992bn.

Nonetheless, Chinese language companies – in Jiangsu and Phnom Penh – are making ready themselves for an unsure spell, if not a turbulent one.

Mr Peng hopes the US and China can have an “amicable and calm” dialogue to maintain the tariffs “inside an inexpensive vary” and keep away from a commerce struggle.

“People nonetheless must buy these merchandise,” he mentioned, earlier than driving off to fulfill new prospects.